Extend Good Samaritan Act to cover food aid for the poor and hungry - Fomca

- Details

GEORGE TOWN: The proposed Good Samaritan Act is a timely intervention as the role of first responders is crucial in times of emergency, the Federation of Malaysian Consumers Association (Fomca) said.

GEORGE TOWN: The proposed Good Samaritan Act is a timely intervention as the role of first responders is crucial in times of emergency, the Federation of Malaysian Consumers Association (Fomca) said.

Fomca vice-president Datuk Indrani Thuraisingham said this was especially so with the high numbers of those suffering from non-communicable diseases including cardiovascular disease, as well as the floods affecting vulnerable communities as a result of climate change.

She, however, called for the proposed law to be extended to cover food aid for the poor and hungry by addressing legal concerns that often hindered individuals, organisations or businesses from donating food.

"The law should explicitly state that individuals, non-profits, and businesses (like restaurants, grocery stores and caterers) donating food in good faith will not be held liable for harm caused by the donated food, as long as the food is safe at the time of donation.

"It should also state that there is no gross negligence, intentional misconduct, or reckless disregard for safety.

"This can encourage more donations by alleviating the fear of lawsuits," she told the New Straits Times.

Indrani said the definition of the Good Samaritan Act should be expanded to include food aid as a recognised act of compassion under the law, alongside traditional emergency assistance.

Read more: Extend Good Samaritan Act to cover food aid for the poor and hungry - Fomca

Rising complaints over faulty, fraudulent second-hand car sales

- Details

KUALA LUMPUR: The National Consumer Complaint Centre (NCCC) has received thousands of complaints about second-hand vehicles, including engine damage and water leakages that cause coolant fluid to mix with engine oil.

KUALA LUMPUR: The National Consumer Complaint Centre (NCCC) has received thousands of complaints about second-hand vehicles, including engine damage and water leakages that cause coolant fluid to mix with engine oil.

As a result, the vehicle's engine needs to be replaced at a high cost, but second-hand car sellers refuse to take responsibility for the damage.

NCCC senior manager Saral James Maniam said these were common complaints from victims who had purchased problematic cars.

As a partner of the Federation of Malaysian Consumers Associations (Fomca), the centre helps consumers resolve issues by acting as intermediaries between consumers and traders.

"Not only do buyers end up with 'defective' vehicles, but some victims purchase cars that were previously involved in serious accidents or have tampered odometers showing lower mileage," she said in a Metro Ahad report.

"Victims feel cheated when they are forced to bear repair costs. Their claims are often ignored by the sellers."

Read more: Rising complaints over faulty, fraudulent second-hand car sales

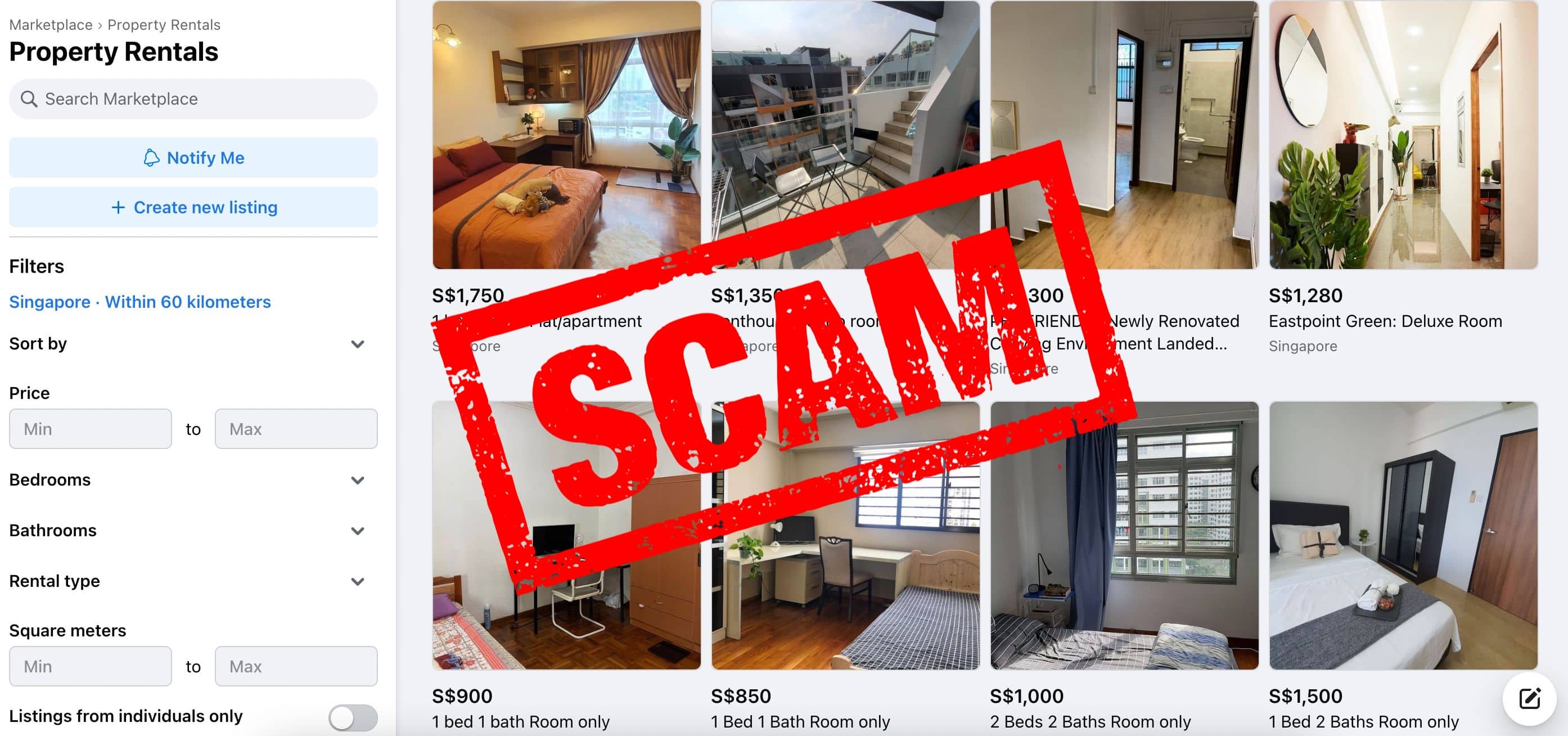

Fomca warns public on surge in fake house rental agent scams

- Details

KUALA LUMPUR: The Federation of Malaysian Consumers Associations (Fomca) today warned the public about a growing trend of scams involving fake house rental agents.

KUALA LUMPUR: The Federation of Malaysian Consumers Associations (Fomca) today warned the public about a growing trend of scams involving fake house rental agents.

Its secretary-general, Dr T. Saravanan, said the fraudsters are pretending to be agents to scam potential tenants, including foreign students, by showing rental properties, collecting down payments and then disappearing.

"Many foreign students have fallen prey to these scams due to their unfamiliarity with local rental practices and lack of access to verified information. The scammers often present themselves as professional agents, using fake business cards, online advertisements and social media profiles to appear credible.

"They arrange property viewings, often of units they do not have legal access to, creating a sense of urgency by claiming high demand for the property. Victims are then pressured to make immediate down payments to secure the unit, only for the agents to vanish after receiving the funds," he said in a statement.

Read more: Fomca warns public on surge in fake house rental agent scams

FOMCA’s Marimuthu slams Ombudsman for Financial Services for claims delays

- Details

THE Federation of Malaysian Consumers Associations (FOMCA) has criticised the delays in settling medical dispute claims by the Ombudsman for Financial Services (OFS).

THE Federation of Malaysian Consumers Associations (FOMCA) has criticised the delays in settling medical dispute claims by the Ombudsman for Financial Services (OFS).

Its president Datuk Marimuthu Nadason said the long wait erodes the trust and confidence of financial services consumers in OFS’s consumer dispute resolution system.

‚ÄúThe OFS was set up to provide fair treatment to consumers. Not all complaints from the financial services sector are accepted by OFS, hence no opportunity for the consumer to be heard,‚ÄĚ he told The Health newspaper.

Marimuthu said the most serious complaint is the long waiting time for a financial service complaint to be resolved. According to the OFS 2022 report, more than 36% of cases were pending for over six months.

He was responding to an article in the March-April issue of The Health on the timeline the OFS took in settling medical claims and financial disputes. Following the article, feedback from readers indicated that it could take more than a year for a dispute to be settled.

Formerly known as the Financial Mediation Bureau, the OFS is supposed to provide independent, fair, efficient and effective dispute resolution to financial consumers. Its service is free for all financial consumers (individuals and SMEs).

Read more: FOMCA’s Marimuthu slams Ombudsman for Financial Services for claims delays

Announce targeted petrol subsidies early, says Fomca

- Details

PETALING JAYA: A consumer group wants the government to announce early when it plans to implement the targeted subsidy for RON95 petrol to enable consumers to adjust to new and possibly higher prices.

PETALING JAYA: A consumer group wants the government to announce early when it plans to implement the targeted subsidy for RON95 petrol to enable consumers to adjust to new and possibly higher prices.

On the other hand, an economist advises against it, saying an early announcement may cause panic buying.

T Saravanan, CEO of the Federation of Malaysian Consumers Associations (Fomca), said prices will rise no matter when the government makes the announcement.

‚ÄúAs a result of the widespread discussions on targeted subsidies for petrol, businesses are already waiting in earnest for its implementation,‚ÄĚ he told FMT.

‚ÄúWhether (the government) announces it earlier or later, prices will definitely rise,‚ÄĚ he said.

‚ÄúSomehow or other, businesses will see additional costs and these will be transferred to consumers,‚ÄĚ he added.

Read more: Announce targeted petrol subsidies early, says Fomca

No extra fee for 5G will help economy but govt must keep watch, says Fomca

- Details

KUALA LUMPUR: The government's commitment to see that mobile network providers do not charge extra for 5G access helps ensure that no consumer is left behind, says the Federation of Malaysian Consumer Associations (Fomca).

KUALA LUMPUR: The government's commitment to see that mobile network providers do not charge extra for 5G access helps ensure that no consumer is left behind, says the Federation of Malaysian Consumer Associations (Fomca).

Its chief executive officer Saravanan Thambirajah said the decision takes into account the rising cost of living and greater 5G adoption should lead to an overall increase in productivity.

"The technology is not only capable of providing a high-speed Internet experience at a rate of 10 to 100 times or up to 1.5GB per second compared to 4G technology, but also has a better quality connection.

"The efficiency of this connection ... has great potential to boost mobile communication, in addition to creating a new industry that brings benefits to the entire economy," he said when contacted.

Saravanan hoped that despite the efficiency of 5G technology, the government will continue to monitor and investigate consumer complaints if any additional charges are imposed.

On Jan 9, Communications Minister Fahmi Fadzil announced that no additional charges would be imposed by telecommunications companies on users for access to the 5G network.

Read more: No extra fee for 5G will help economy but govt must keep watch, says Fomca

LETTER | National Scam Response Centre must be reformed

- Details

LETTER | Despite the best efforts of the National Scam Response Centre (NSRC), scams continue to increase, impacting severely the financial, psychological and social well-being of consumers.

LETTER | Despite the best efforts of the National Scam Response Centre (NSRC), scams continue to increase, impacting severely the financial, psychological and social well-being of consumers.

In 2023 alone, according to the NSRC, overall losses due to scams totalled RM1.34 billion. In the instance of investment scams, losses more than doubled from RM209 million in 2022 to RM437 million in 2023, an increase of over 109 percent within a year.

Those affected by scams are not only ordinary consumers but also include the professional, the educated and the articulate. Thus clearly, every consumer is a potential victim of a scam.

Recognising that frequently the losses due to scams may not be recovered despite the best efforts, the best protection is certainly self-protection. Once you are a victim the possibility of recovering your losses is slim.

Read more: LETTER | National Scam Response Centre must be reformed

Co-payment concerns grow

- Details

PETALING JAYA: A leading consumer group has expressed concerns over Bank Negara Malaysia‚Äôs recent announcement that insurance companies must introduce medical and health policies with a ‚Äúco-payment‚ÄĚ feature option starting Sept 1.

PETALING JAYA: A leading consumer group has expressed concerns over Bank Negara Malaysia‚Äôs recent announcement that insurance companies must introduce medical and health policies with a ‚Äúco-payment‚ÄĚ feature option starting Sept 1.

The Federation of Malaysian Consumers Association (Fomca) said the announcement lacks clarity on the implementation timeline and details, leaving a large part of the process ‚Äúvague‚ÄĚ.

Its chief executive officer Saravanan Thambirajah said the co-payment feature would create more issues for consumers, as they might have to fork out more money for their medical coverage.

“We know how time consuming it can be for consumers to get their guarantee letters and other insurance documents sorted out before admission to hospitals.

“Some have no choice but to pay out of their pocket first, hoping to claim it back later.

‚ÄúThe claims take time and may not be fully reimbursed. Consumers will ultimately have to pay more at hospitals,‚ÄĚ he said.

Saravanan said the announcement is not welcome as it is unclear how co-payments would ‚Äúencourage consumers to take a more active role in their medical health insurance coverage and claims‚ÄĚ.

‚ÄėDo more to encourage usage of energy-efficient appliances‚Äô

- Details

PETALING JAYA: More allocation should be given to support the rebate programme encouraging usage of energy-efficient appliances, says a consumer group.

PETALING JAYA: More allocation should be given to support the rebate programme encouraging usage of energy-efficient appliances, says a consumer group.

Federation of Malaysian Consumers Association (Fomca) chief executive officer Dr Saravanan Thambirajah said that by providing more cash, it would allow consumers to participate in sustainable practices.

‚ÄúThe government should also add more eligible appliances, not only air conditioners and refrigerators,‚ÄĚ he said, commenting on the Sustainability Achieved Via Energy Efficiency (SAVE) 4.0 by the Sustainable Energy Development Authority (Seda).

Last December, Natural Resources, Environment and Climate Change Minister Nik Nazmi Nik Ahmad said RM50mil was allocated for the programme.

Consumers were allowed to receive rebates worth up to RM400 that can be used to purchase energy-efficient air conditioners and refrigerators with four- or five-star labels issued by the Energy Commission.

Read more: ‚ÄėDo more to encourage usage of energy-efficient appliances‚Äô

Fomca tolak cadangan ruang khas merokok

- Details

PETALING JAYA: Gabungan Persatuan Pengguna Malaysia (Fomca) menolak cadangan penyediaan kawasan khas merokok khususnya bagi premis makanan di kawasan sempit.Penyelaras kawalan tembakau Fomca Sha’ani Abdullah berkata ini kerana tindakan itu bercanggah dengan dasar kawalan tembakau negara.

PETALING JAYA: Gabungan Persatuan Pengguna Malaysia (Fomca) menolak cadangan penyediaan kawasan khas merokok khususnya bagi premis makanan di kawasan sempit.Penyelaras kawalan tembakau Fomca Sha’ani Abdullah berkata ini kerana tindakan itu bercanggah dengan dasar kawalan tembakau negara.

Beliau berkata jika kawasan merokok perlu, ia harus menyokong objektif menyahnormalkan tabiat merokok seperti menawarkan keselesaan kepada perokok, termasuk perlindungan dan tempat duduk.

‚ÄúHanya kotak bertanda merah di atas lantai (perlu disediakan),‚ÄĚ kata Sha‚Äôani dalam satu kenyataan.

Tambahnya, kanak-kanak tidak seharusnya terdedah kepada kawasan tersebut, bagi mengelakkan mereka terjebak dengan tabiat merokok.

Page 7 of 103